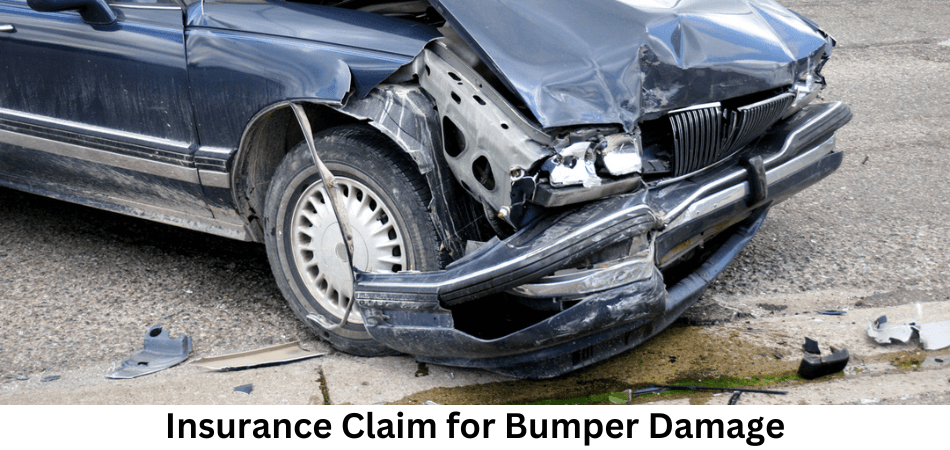

Bumpers being the first part of the car to sustain damage in an accident is a common occurrence. If your bumper is damaged, it could be because you ran into something or someone. The cost of repairing the bumper may be covered by your insurance. Thinking, “How much does insurance pay for bumper damage?” or, Should I file an insurance claim for bumper damage? The answer depends on your coverage type, and in some cases, it may be more beneficial to pay for the repair out of pocket.

Knowing the scope of the damage and the details of your insurance policy will help you make this call. Car insurance is vital, but minor bumper damage may not require a claim.

If you’re considering purchasing car bumper damage insurance, be sure to compare quotes to find the best rates for your needs.

How Much Does it Cost to Fix a Bumper?

Several factors determine how much it costs to repair a car bumper, including the type of car, the year, the bumper material, any paint repairs, and the severity of the damage. Replacing a bumper can cost $1,000 or more, and using aftermarket parts may lower the cost but may also affect the vehicle’s resale value.

Your insurance may cover the repair cost, minus your deductible. Quality should not be compromised to reduce costs in the long run.

By using aftermarket parts instead of OEM parts, you can reduce the cost, but the resale value of the vehicle will be reduced.

When Does Insurance Cover Bumper Damage?

In most cases, if you have comprehensive and collision coverage, your insurance company will reimburse you for the cost of repairing and repainting your bumper. The state minimum policy does not include these types of coverage – basic liability coverage will not pay for bumper repairs.

Although full coverage insurance rates are generally higher, the difference is not as significant as you might think. There is only about $36 difference between basic coverage and full coverage, with full coverage averaging $345 per month. As a result of full coverage, you are protected regardless of whether you were at fault for the accident.

For about $25 extra per month, you could get by with only collision insurance if you have bumper damage caused by a collision. When a bumper is damaged by an animal, vandalism, or a storm, collision insurance will not cover it.

For each type of coverage, let’s see what the average annual premium is. A low-limit or liability-only policy will not cover your bumper, whereas a high-limit or comprehensive policy will.

Is Bumper Damage Covered by Auto Insurance?

Car insurance might or might not cover bumper damage depending on your policy and who damaged the bumper.

How Much Does Auto Insurance Pay for Bumper Damage?

Liability Coverage

You will be covered for bumper damage you cause to another car if you have a liability insurance policy, but not for bumper damage to your own car.

In most states, liability coverage is the minimum amount of car insurance that registered car owners must purchase, except for New Hampshire where mandatory car insurance is not required.

Collision and Comprehensive Insurance

Look into collision and comprehensive auto insurance if you want to protect your car’s bumper from damage.

An insurance policy that covers liability does not cover collisions and comprehensives. Standard liability policies do not include these optional add-on coverages, so you must purchase them separately.

Collision Coverage

The purpose of collision insurance is exactly what it sounds like: to protect you and your vehicle in the event of a collision. It is generally defined as a collision when your vehicle collides with another vehicle or pedestrian, or when your vehicle collides with another vehicle or pedestrian.

Comprehensive Coverage

Comprehensive coverage covers damage to your vehicle caused by accidents other than collisions with other vehicles or inanimate objects. Car insurance comprehensive coverage is considered a catch-all policy.

Should I Call My Insurance Company After a Minor Accident?

In the case of a minor accident, even if there are other people involved, you should always contact your insurance company.

When you’ve been in an accident with other people (either as passengers in your own car or in another vehicle), your insurance company may have firm guidelines about how long you have to wait before reporting the accident.

Immediately report the collision to your insurance company, but you may have up to 30 days within which you are legally responsible for informing them.

Don’t forget, though, that reporting an accident and starting the car insurance claim process aren’t the same thing, and you may not have to do both.

Should I file an Insurance Claim for Bumper Damage?

Your insurance company may ask you whether you should file a claim for bumper damage after a fender bender. And you may think, “How much does insurance pay for bumper damage?”

However, consider the potential consequences of filing a claim, which could result in increased premiums for several years. Also, out-of-pocket deductible expenses. To help decide, answer these questions first:

Was anyone injured?

Report bumper damage to your insurance company promptly, regardless of fault. Paying out-of-pocket and keeping the incident from your insurer may lead to legal consequences, such as lawsuits for injuries, later on.

Was another driver involved?

When another driver is involved in the accident, the situation becomes more complicated. In the case of an accident involving multiple drivers.

Filing a claim can help handle the situation smoothly, but you can also opt to handle it out of pocket if you have the finances and the other parties agree.

Low deductible

Deductibles are amounts you need to pay out of pocket. Before your insurance policy covers the remaining cost of damages or losses. If your deductible is lower, you will have less money to spend. It only takes a small amount of money to pay for your insurance.

For example, if your deductible is $250, you would pay $250 out of pocket for repairs or damages before your insurance covered the remaining cost.

High repair costs

It can be hard if the cost of fixing the damage is high. You can get financial aid from your insurance provider in this case by filing a claim with them. As a result, your financial burden will not be as heavy. Knowing that your insurance will cover the cost of the repairs is a huge weight off your shoulders.

When to Consider Filing a Claim for a Fender Bender?

The following situations may warrant filing a bumper damage claim:

If you must pay for damage or medical bills caused by another driver, you may need to inform your insurance company and file a claim.

In the event that the cost of the expenditure exceeds your deductible and is too high for you to cover on your own, filing an insurance claim may be the best option.

The other driver’s fault: In the event that your bumper was damaged by the other driver’s negligence, you can seek liability coverage from that driver’s insurance company.

When to consider not filing a claim for a fender bender

In some cases, not filing a claim for bumper damage after a fender bender may be a better option. This includes if you are solely responsible for the damage, if your car has no other damage, or if you recently filed a claim.

Even though it results in a higher premium down the road, insurance can offer financial relief if you are unable to pay to have the damage repaired.

Only your car is harmed: If you weren’t held accountable and there weren’t any other vehicles involved. You could decide to pay to have your car fixed.

When your insurance policy doesn’t provide full coverage. Do not make a claim that can even make more sense.

You recently received a claim: The cost of your premium could significantly rise. If you’ve filed a claim during the previous three to five years. Furthermore, it can label you as a high-risk driver.

How Long After an Accident Can You File an Insurance Claim?

If you damage your vehicle in an accident, most insurance companies let you file a claim two years after the incident. Depending on where you live or where your insurance policy is issued, the time period may vary.

There are parts of the country where drivers have only one year (or less) to decide if filing a claim is worth it, while other parts give them up to 10 years.

Although the law protects your right to file a claim after an accident happens, waiting may not always be in your best interest. Even if you initially reported the accident to your insurance company, it is difficult to prove that the accident occurred months or even years ago caused the damage you are reporting.

It’s important to document everything along the way if you’re unsure whether or not you want to file an auto claim to help cover the cost of repairs after a minor accident. It is important to be able to demonstrate the damage caused by the incident long after it occurred to have a better chance of getting your claim approved.

Will My Insurance Rates Go Up If I File a Claim for Bumper Damage?

The cost of insuring low-risk drivers is lower for insurance companies. The cheapest insurance rates go to low-risk drivers because of this.

Most low-risk drivers do not file a lot of claims or have a lot of claims filed against them. An insurance company does not like to see a lot of claims on a policy. It is therefore possible for your car insurance premiums to increase if you file multiple claims.

There are, however, some things you can do to reduce your car insurance costs even if you have to file a claim for bumper damage.

Maintain a Safe Driving Record

Driving safely is the best way to maintain a low car insurance rate. The more you drive safely, the less likely you are to get into an accident. In addition, safe driving reduces your chances of being involved in an accident that is your fault.

It’s good news because no-fault and first-time accidents won’t likely increase insurance rates, especially if nobody is injured and property damage is minimal.

Ask About Accident Forgiveness Programs

Auto insurance accident forgiveness programs are worth considering if you’re shopping for coverage or already have one.

The accident forgiveness program prevents your insurance premiums from being raised after an accident. The eligibility requirements vary from provider to provider, so discuss them with the provider before signing up. For example, if you haven’t been in an accident in the past three years, you may qualify for accident forgiveness.

How Much does Insurance Pay for Bumper Damage?

Insurance companies’ bumper repair payouts vary based on a number of factors. You have to think about How Much Does Insurance Pay for Bumper Damage? And for that you have to consider things like how bad the damage is, how much insurance you have, and the policies of your insurance company.

Insurance companies that offer collision coverage will pay for the cost of repairing or replacing your bumper. Full protection is available to you.

If the bumper needs to be repaired or replaced, the insurance company will cover the cost, less the deductible. You may have damage to your bumper if it has been damaged by theft, vandalism, or the weather.

Bumper-to-Bumper Cover

Comprehensive car insurance policies do not cover regular wear and tear or consequential damage. As a result, the insurer might not fully reimburse you if you make a claim for such damages.

Indirect harm that results from a direct loss, such as engine damage from hydrostatic loss, is an example of consequential harm.

Accordingly, the insurance company will calculate the total amount to be paid by taking into account depreciation when the policyholder files a claim.

Insurers will pay depreciated values to policyholders, while the policyholder will pay the market value.

It’s important to note that the depreciation amount can make up a significant portion of the total claim.

By choosing a bumper-to-bumper add-on cover, you can protect yourself from depreciation and ensure comprehensive coverage for your vehicle.

Car Insurance Policy Bumper to Bumper: Things to know

In my opinion, comprehensive car insurance would be the ideal plan for you. With comprehensive insurance you can protect your vehicle against fire, theft, vandalism, and other events as well as third-party liability. It is important to be aware, however, that comprehensive auto insurance has some exclusions.

A comprehensive car insurance policy may only cover part of the expenses in the event of an accident, which is quite frustrating. As a result, you are not offered the full claim amount by your insurance company. In addition to the amount that you are eligible to receive, you will not receive:

Compulsory Deductibles –

- Deficiencies are predetermined amounts deducted from insurance claims by car insurance providers.

- Several factors determine this value, such as the cubic capacity of the engine, the age of the vehicle, and the make and model.

- Vehicle insurance premiums are not affected by compulsory deductibles.

Voluntary Deductibles –

- A voluntary deductible percentage is agreed upon between a car owner and the insurance company at the time of policy purchase. The amount the car owner can afford depends on the car’s risk bracket and the amount they can afford to insure it.

- A voluntary deductible essentially means the policyholder pays a portion of the claim amount if he or she makes a claim.

- Once the voluntary deductible has been paid, the car insurance kicks in and reimburses the remaining claim amount.

- By choosing a higher voluntary deductible, you can lower your car insurance premium.

- With a good disposable income, a confident driver can lower his/her regular insurance premium by increasing their voluntary deductible.

Depreciation –

Over time, a vehicle’s value diminishes due to depreciation. It depends on the age and condition of your car how much depreciation it will suffer. Insured Declared Value (IDV) is directly proportional to depreciation, so insurance premiums are affected.

Conclusion

When a bumper is damaged, people frequently wonder if they should file an insurance claim. And how much does insurance pay for bumper damage? It frequently happens like that.

It is typically covered by full coverage policies, but filing a claim is unnecessary if the cost of the repairs is less than your deductible. To ensure comprehensive coverage, consider shopping for a policy that covers bumper damage.

Read More How Much Does A Jeep Wrangler Weigh?

FAQ

How much does insurance pay for bumper damage?

Policies, deductibles, and repair costs affect how much you pay. Your insurance company should cover the remaining amount if your repair costs exceed your deductible under a full coverage policy. If the repair costs are low, filing a claim may not make sense since you would have to pay for the repairs yourself.

Which kinds of bumper damage are protected by insurance?

Theft, vandalism, weather events, and other covered perils can damage bumpers. Insurance does not cover normal wear, cosmetic damage, or consequential damage.

Do bumper damage claims increase insurance rates?

The policies of your insurance company, your policy, and your driving record. When you file a claim or have an accident, your rates may change. Failure to file a claim can also result in paying for the repair out of pocket or facing a lawsuit.

Would a bumper-to-bumper add-on cover prevent depreciation?

It depends on your budget and needs. A bumper-to-bumper policy add-on might offer comprehensive coverage for your car, possibly even covering components that a standard policy might not.

What should I do if I have bumper damage?

You may want to consider these steps if you have bumper damage: take pictures or videos, gather information about the other vehicle if another vehicle was involved, report the accident to your insurance company, inquire about your insurance coverage and deductible, and get a quote from a reputable repair shop for repairs.

Leave a Reply